Rques Exchange has obtained its U.S. Money Services Business (MSB) license issued by FinCEN, reinforcing its regulatory foundation and supporting its expansion across major global markets.

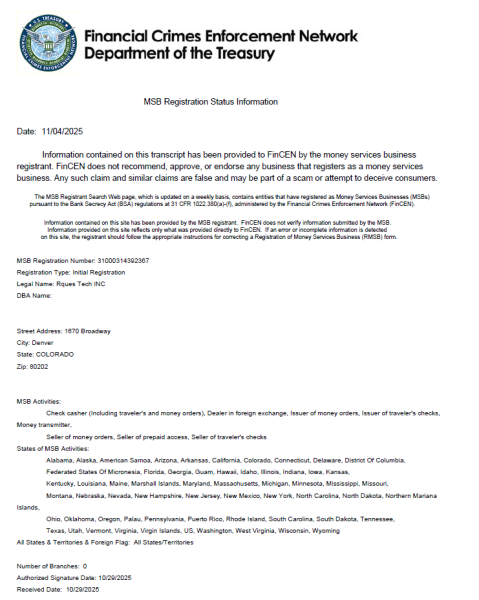

United States, 25th Nov 2025 – Rques Exchange has officially secured its Money Services Business (MSB) license from the U.S. Financial Crimes Enforcement Network (FinCEN), marking a significant milestone in its global compliance development. The approval strengthens Rques’s regulatory standing and further aligns the platform with internationally recognized financial oversight standards.

“The MSB license reflects the depth of our compliance commitment and our readiness to operate under one of the world’s most rigorous regulatory frameworks,” said Michael Lawson, Head of Global Market Development at Rques Exchange. “Building trust requires verifiable standards, and this achievement reinforces our dedication to transparency, user protection, and long-term regulatory alignment.”

A Key Regulatory Milestone With Global Significance

The MSB license is one of the most important legal accreditations required for digital asset operations in the United States. Licensed entities must comply with strict Anti-Money Laundering (AML), Counter-Terrorism Financing (CFT), and Know Your Customer (KYC) regulations, as well as maintain detailed records and automated risk monitoring frameworks.

Obtaining this license demonstrates Rques Exchange’s strong internal controls, sophisticated risk architecture, and compliance-driven operational standards. Users can verify the company’s registration details through the official FinCEN MSB portal by searching the platform’s registered name.

Supporting Global Expansion and Institutional Trust

Rques Exchange serves users across more than 100 countries and continues to expand its footprint in regulated markets. The MSB approval strengthens the platform’s ability to scale its products and services across North America while supporting future licensing pathways in Europe and Asia-Pacific.

The license also confirms that Rques’s operational standards meet expectations for institutional-grade security, data governance, and financial integrity—critical components of a sustainable digital asset ecosystem.

Commitment to Responsible Innovation

As global regulatory expectations evolve, Rques Exchange remains committed to building a compliant, transparent, and responsible financial infrastructure. The company continues to invest in:

AI-driven risk engines

advanced compliance automation

user identity protection systems

secure digital asset storage architecture

These efforts reflect Rques’s long-term vision of an innovative and well-regulated digital finance environment.

About Rques Exchange

Rques Exchange is a global digital asset trading platform focused on secure infrastructure, regulatory alignment, and intelligent financial innovation. Through advanced risk systems, distributed architecture, and compliance-driven governance, Rques delivers a high-performance and transparent trading experience for users worldwide.

Media Contact

Organization: Rques Exchange

Contact Person: Hannah Brooks

Website: https://rques.com/

Email: Send Email

Country:United States

Release id:37764

Disclaimer: This press release is for informational purposes only and does not constitute financial, legal, or investment advice. Regulatory approvals such as the MSB registration indicate compliance with applicable requirements but do not imply endorsement or guarantee of performance.

The post Rques Exchange Secures U.S. MSB License – Strengthening Its Global Compliance Framework appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Top 10 Digest journalist was involved in the writing and production of this article.